Changes to Benefit in Kind (BIK) on Company Vehicles:

Changes to Benefit in Kind (BIK) on Company Vehicles:

At the beginning of 2023 the BIK system moved to a CO2 based system to encourage the use of lower emission cars and electric vehicles in order to help incentivise a move to cleaner and less polluting. However, since this new benefit came into effect, businesses with company cars and vans experienced an increase in their income tax liabilities. The changes hit a large number of the estimated 150,000 drivers of company vehicles.

On the 7th of March 2023, the Government announced temporary changes to the Benefit In Kind (BIK) calculations for company vehicles. The Government said that in the Finance Bill 2023, it will temporarily introduce a relief of €10,000 on the Original Market Value (OMV) of some vehicles, upon which the tax is calculated.

Company Cars 2023:

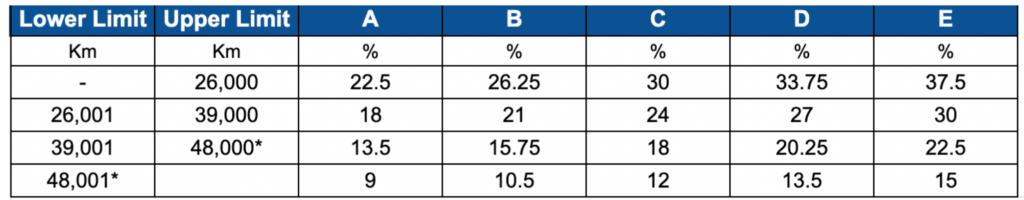

The Original Market Value (OMV) of cars in Category A, B,C and D, will be reduced by €10,000 which will consequently reduce the BIK charge. This reduction is not applicable to cars in Category E. The table below shows amount of miles travelled and CO2 emission category (new temporary changes)

Company Vans and Electric Vehicles 2023:

This benefit will also apply to all vans and electric vehicles. For electric vehicles, the OMV deduction of €10,000 will be in addition to the existing relief of €35,000 that is currently available for EVs, meaning that the total relief for 2023 will be €45,000. The cash equivalent for vans will be calculated as 8% of the OMV, with a €10,000 reduction in the OMV.

Payroll:

These temporary measures will apply retrospectively from 1st January 2023 until 31st December 2023. It is proposed to introduce these measures at Committee Stage of the Finance Bill 2023. While it is envisaged that these measures will be signed into law as outlined, it may be advisable for employers to delay any recalculations of BIK until the Finance Bill 2023 has been enacted. Recalculations can be carried out at that point in time as necessary, and employers are not required to amend previous payroll submissions to account for these changes.

Get in Touch:

If you have any doubts about the Benefit In Kind (BIK) calculations, please click here to book a no obligation call today.