Auto-Enrolment: A New Pension Scheme

Starting January 2025, a new pension savings scheme called Auto-enrolment will be introduced in Ireland. This initiative is designed to enhance retirement savings for employees who are not currently contributing to a pension plan. Here’s what you need to know about Auto-enrolment and how it will affect you.

What is Auto-enrolment?

Auto-enrolment is a pension savings scheme where certain employees who are not currently paying into a pension will be automatically included. However, employees have the option to opt-out after six months. Under this scheme, contributions are made by the employee, the employer, and the Government into the employee’s pension fund.

A new public body, the National Automatic Enrolment Retirement Savings Authority (NAERSA), will be established to administer the scheme and ensure its smooth operation.

Who Will Be Automatically Enrolled?

You will be automatically enrolled in the new pension scheme if you:

- Are aged between 23 and 60

- Are not currently part of a pension plan

- Earn €20,000 or more per year

If you previously contributed to a pension but no longer do, and you meet the other conditions, you will also be automatically enrolled. If you earn less than €20,000 per year or are outside the age range of 23 to 60, you can choose to join the scheme if you are not already part of a pension plan.

Employer Participation

Employers are required to participate in the Auto-enrolment scheme. Failure to meet their obligations can result in penalties and prosecution. If employers do not make contributions on behalf of their employees, they may face fines and be required to make repayments with interest.

Existing Workplace Pensions

If you are already contributing to a workplace pension plan, you will not be enrolled in the new Auto-enrolment scheme. This ensures there is no duplication or confusion regarding your pension contributions.

Changing Jobs After Enrolment

Auto-enrolment features a ‘pot-follows-the-member’ approach. If you change jobs after being enrolled, you will remain a member of the Auto-enrolment scheme without needing to transfer your pension or join a new scheme. NAERSA will manage this transition for you.

Opting Out and Suspending Contributions

You must stay in the pension scheme for at least six months after being enrolled. If you choose to opt out after this period, your contributions will be refunded. Opting out is also allowed in the seventh or eighth month after a change in contribution rates, with refunds based on the difference between old and new rates during the previous six months. This option is available during the first ten years of the scheme as contribution rates gradually increase.

You can also suspend your contributions at any time, but no refund will be given in this case. Contributions not refunded, including those made by your employer and the Government, will remain invested in your pension pot.

Savings and Re-enrolment

If you opt out or suspend contributions, your savings will continue to be invested, ensuring you still have access to a pension pot at retirement. If you stop working or move abroad, you will remain enrolled, but no additional contributions will be made.

You will be automatically re-enrolled after two years if you are still eligible unless you have an alternative pension plan. You can also rejoin the plan at any time within the two-year period.

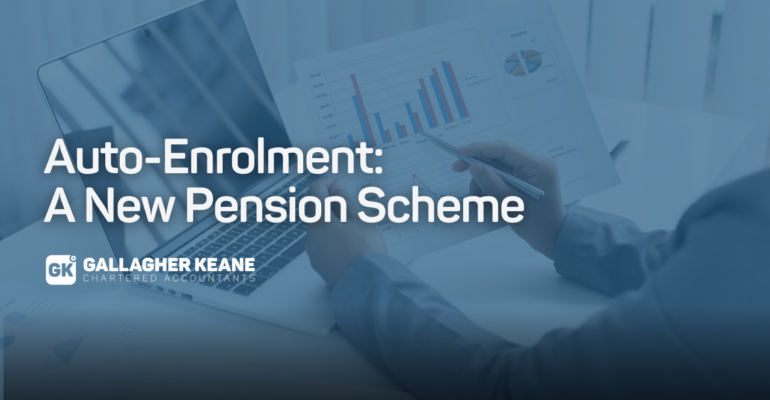

Contribution Rates

The contribution rates are predetermined and will gradually increase over ten years:

Example

The table below includes an example of a worker earning €20,000 a year:

Maximum Contribution

For every €3 you contribute to your pension fund, your employer will contribute €3, and the Government will add €1. This means for every €3 you contribute, a total of €7 will be added to your account. Both employer and Government contributions are capped at an annual salary of €80,000.

- For the first three years, the maximum amount an employer can contribute is €1,200 per year, and the Government’s maximum contribution is €400 per year.

- If you earn over €80,000, contributions on income above this amount will not be matched by your employer or the Government.

For more information or guidance on how pensions work, visit a Citizens Information Centre or call the Citizens Information Phone Service on 0818 07 4000.

Contact us:

At Gallagher Keane, our dedicated team of professionals is committed to providing business owners with valuable support. We take care of various administrative tasks, forecasting, and accounting management on behalf of your organisation.