New Company Thresholds for Audit Exemptions

New Company Thresholds for Audit Exemptions

The European Union (Adjustments of Size Criteria for Certain Companies and Groups) Regulations 2024 have brought significant changes to the classification of companies under the Companies Act 2014. Effective from 1 July 2024, the new regulations increase the balance sheet and turnover thresholds for ‘micro’, ‘small’, ‘medium’, and ‘large’ companies by 25%. This adjustment means more Irish companies will qualify as micro or small and thereby benefit from abridged reporting and audit exemption.

Key Changes to Company Size Thresholds

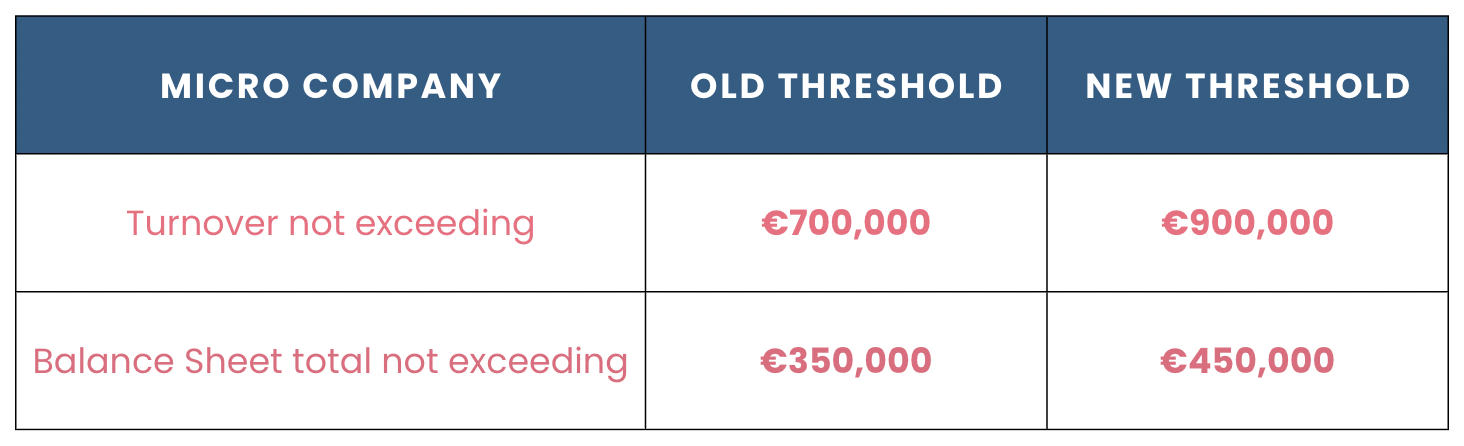

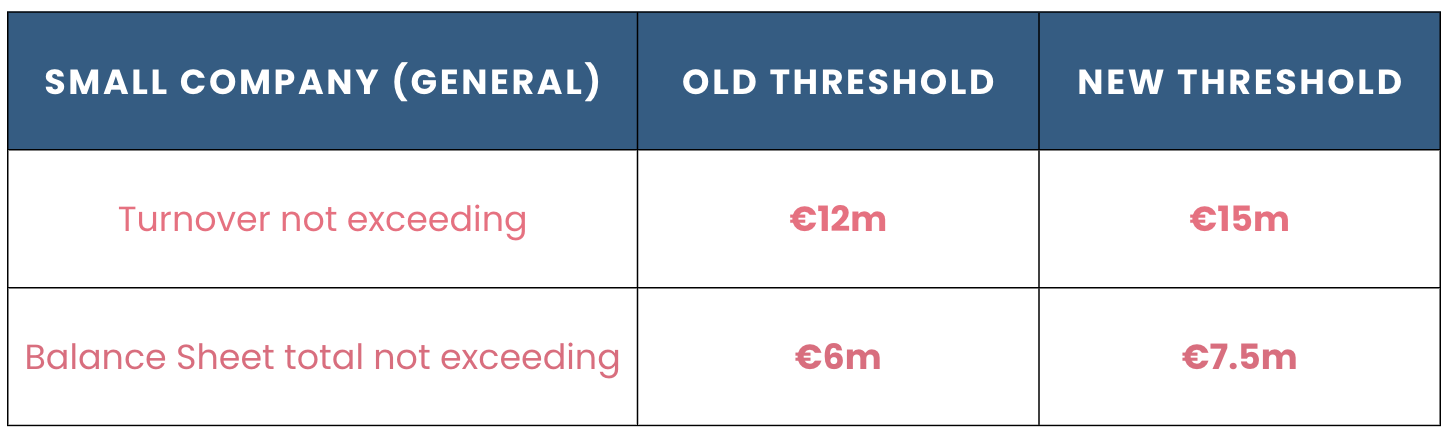

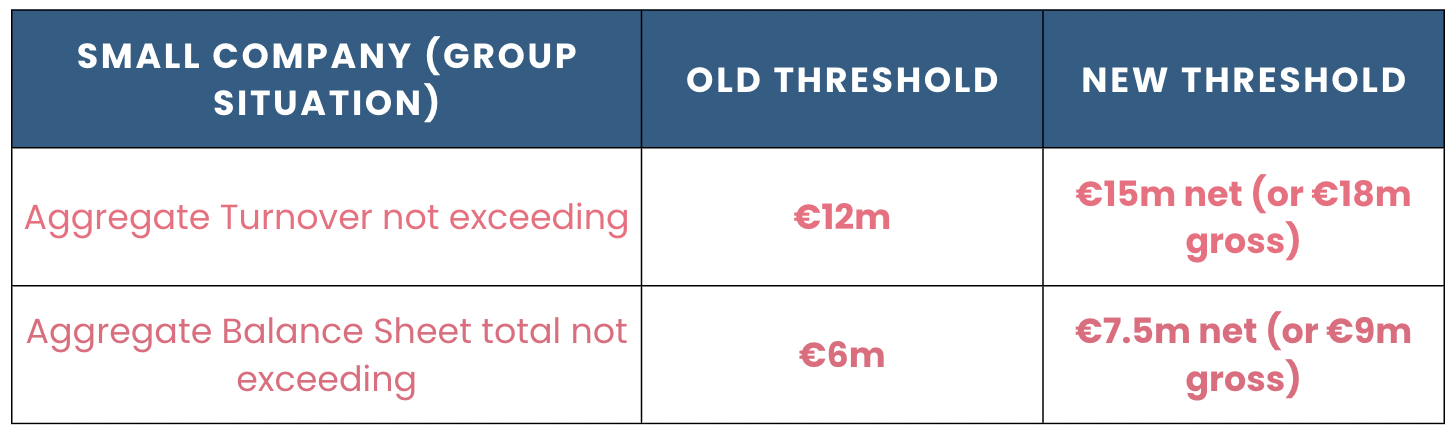

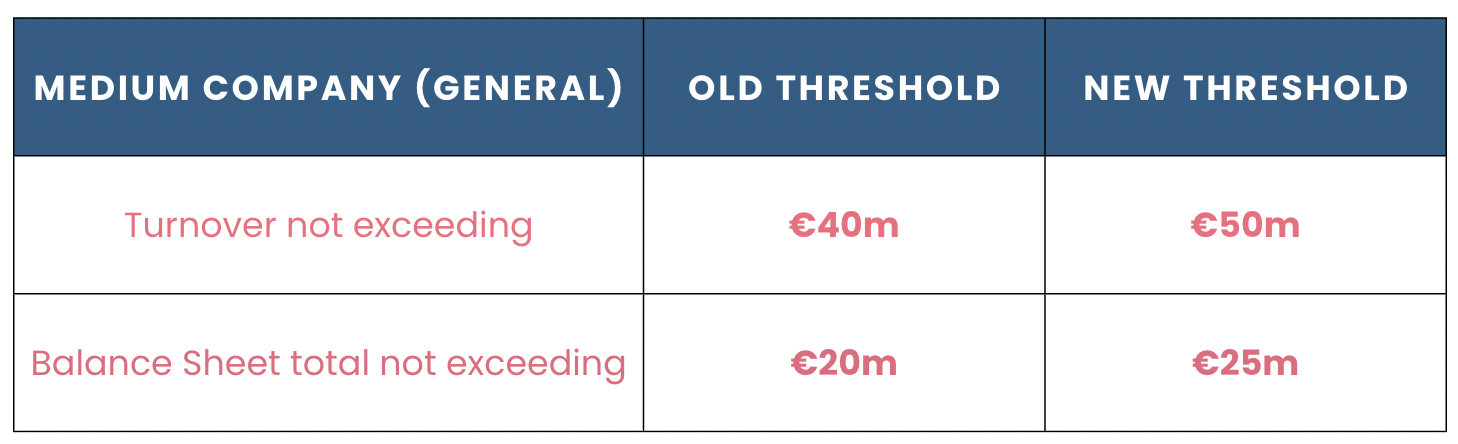

The updated thresholds will apply for financial years starting from 1 January 2024, with an option for companies to apply them from 1 January 2023 in certain circumstances. Here’s a detailed look at the changes:

Micro Company:

Small Company (General):

Small Company (Group Situation):

Medium Company (General):

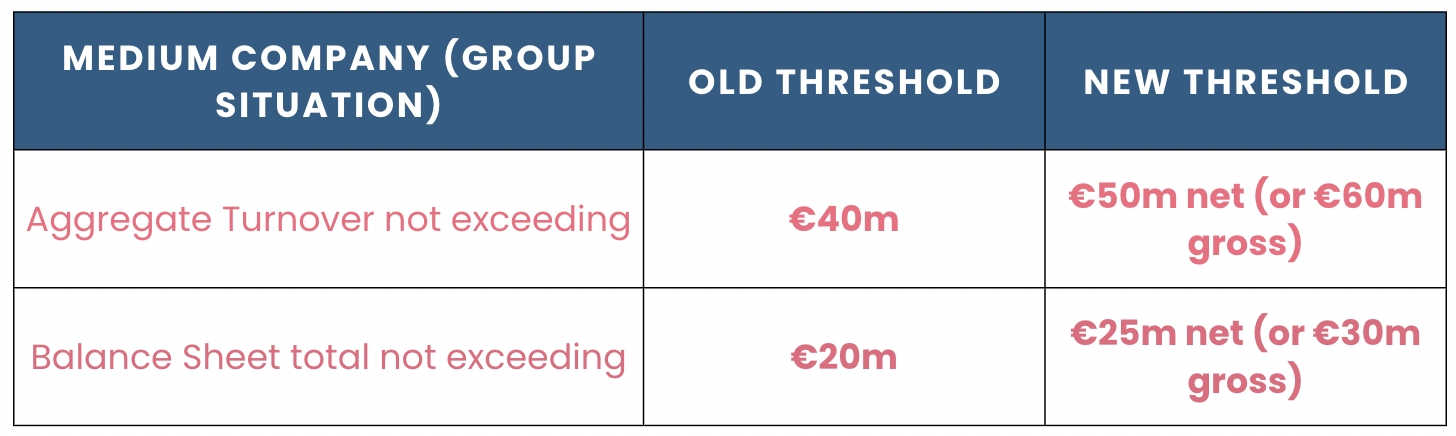

Medium Company (Group Situation):

Impact on Irish Businesses:

The new thresholds are designed to reduce the cost of doing business by lessening the reporting and regulatory burdens for qualifying companies. More businesses will now be classified as micro or small, allowing them to avail of abridged reporting requirements and audit exemptions. This change is expected to enhance business agility, decrease compliance costs, and foster a more conducive environment for growth and innovation.

Contact us:

Navigating these regulatory changes can be complex, but Gallagher Keane Accountants are here to help. Our experienced team can provide the expertise and guidance needed to ensure your business complies with the new thresholds and maximises the benefits available.

Whether you need assistance with financial reporting, understanding the new audit exemptions, or any other corporate governance matter, we are here to support you.