Understanding Transborder Workers’ Relief

At Gallagher Keane, we recognise the importance of understanding tax relief options for individuals who live in one country and work in another. One such option available to residents of Ireland is the Transborder Workers’ Relief. This relief is designed to alleviate the tax burden for those who reside in Ireland but work and pay tax in another country. Here’s everything you need to know about this relief, who qualifies, and how to apply.

What is Transborder Workers’ Relief?

Transborder Workers’ Relief is a tax relief available to individuals who are residents of Ireland but travel daily or weekly to work in another country where they pay tax. This relief ensures that such individuals are not doubly taxed on their income, providing significant financial relief.

Who Qualifies for Transborder Workers’ Relief?

To qualify for this relief, you must meet the following criteria:

- Tax Resident in Ireland: You must be a tax resident in Ireland.

- Work in a Country with a Double Taxation Agreement: Your employment must be in a country that has a double taxation agreement with Ireland.

- Paid Tax in the Other Country: You must have paid tax in the country of employment and are not due a refund of that tax.

- Presence in Ireland: You must be present in Ireland for at least one day for every week you work abroad.

- Continuous Employment: The employment must be held for a continuous period of 13 weeks in the year.

Additionally, you cannot claim this relief if:

- You or your spouse or civil partner are proprietary directors of the company you work for abroad.

- You avail of Foreign Earnings Deduction.

How Do You Calculate How Much Relief is Due?

The ‘specified amount’ is calculated as follows:

Total Irish tax due x income (other than foreign employment income)/total income.

You will not receive any credit for foreign tax paid if you qualify for transborder relief.

Example:

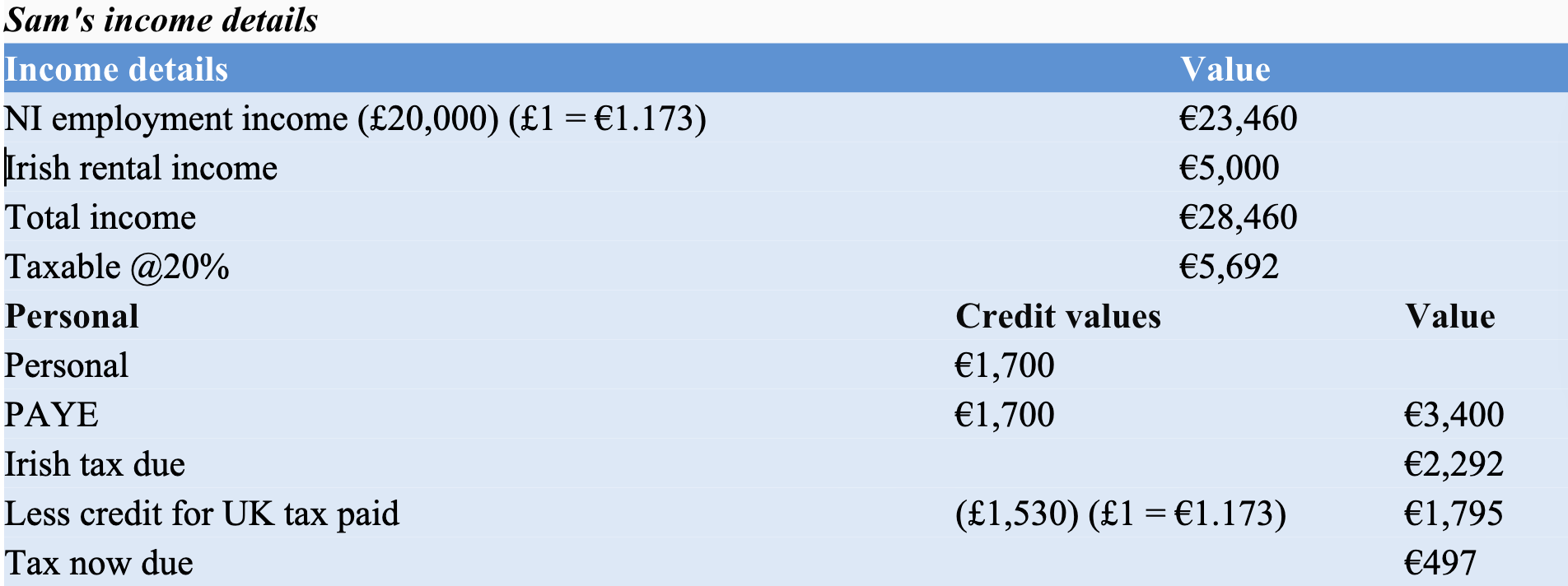

In 2022, Mark was a resident in Ireland and employed in the United Kingdom He earned £20,000, along with an Irish rental income of €5,000.

How Transborder Workers’ Relief operates:

Specified amount: €2,292 x (€5,000 / €28,460) = €403

The total tax due is €403

Benefit of Transborder Workers’ Relief:

This gives a saving of €1,889 (€2,292 - €403).

If the taxpayer had no rental income, the specified amount would be zero.

How Do You Apply for Transborder Worker’s Relief?

You may apply in writing to your Revenue Office for this relief. In your application, you must include a final statement of income tax liability from the other country. Alternatively, the relief may be claimed by completing an Income Tax Return.

Contact us:

For personalised assistance and further inquiries on applying for Transborder Workers’ Relief, feel free to contact Gallagher Keane. We are here to help you navigate through the complexities of tax relief and ensure you get the maximum benefit you are entitled to.